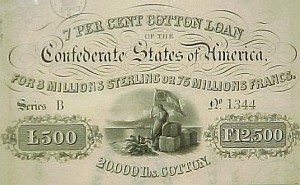

Confederate Erlanger Cotton Bond (1863)

Confederate Erlanger Cotton Bond (1863)

Financing the building of a navy abroad presented a challenge to the Confederacy. Vessels like ‘290’ were expensive, costing about $250,000 in gold in 1862, or roughly $5,820,000 in today’s federal dollars.

To meet such expenses, one member of President Davis’s cabinet—Secretary of War Judah Benjamin—argued early on for a policy of sending bales of government-owned cotton (at least 100,000 of them) immediately to Europe, before the federal blockade of the South could take hold. The proceeds from foreign sales of these bales (by one estimate, as much as $50,000,000) would be kept abroad to fund the expense of arms, materiel, and naval vessels critical to the Confederate war effort.

Initially, though, the Confederate government took a contrary tack and embargoed all cotton sales to Europe. The belief was that by starving British and French textile mills, the Confederacy would create political pressure for diplomatic recognition. As the war expanded and lengthened, the Confederate government came to the belated recognition that a reservoir of international funds was essential to keeping its land and naval forces supplied.

In January, 1863, the Confederate Congress authorized the Paris bankers of Erlanger et Cie. to underwrite an issue of $15,000,000 worth of Confederate bonds. The bonds were issued in four denominations; were valued in dual currencies—British pounds and French francs; and were convertible into cotton at a fixed rate of 12 cents per pound. At the time of issuance in March, 1863, cotton sold in Europe for about 48 cents a pound, amounting to a 400% windfall to buyers.

But the buyers needed to read the fine print: “[T]he cotton will be delivered . . . if [during] war, at a point in the interior [of the Confederacy] within 10 miles of a railhead or stream navigable to the ocean.” In other words, to get that 400% bondholders would have to arrange to ship their cotton out of the Confederacy through the blockade. In 1863 this was problematic, as Secretary Benjamin had foreseen two years earlier. Some buyers tried; a few succeeded. Most held onto the bonds, hoping for eventual Confederate success.

At the end of the war, the victorious Union repudiated the Confederate war debt by Constitutional amendment (XIV, §4). The Erlanger bonds nonetheless continued to trade on the London Stock Exchange until 1871, sustained by occasional rumors that the bonds would be redeemed.

In a sense, some ultimately were. In 1987, a cache of Erlanger bonds discovered lying dormant in a British bank vault sold for approximately $550,000. At today’s exchange rates, the face value of a £100 bond (like the one owned by the author) would be about $160. Collectors today might pay $300-$375 for such a bond (depending upon condition and presence of coupons). 100% over face value is not a bad premium—if you were willing to wait 150 years to realize it.